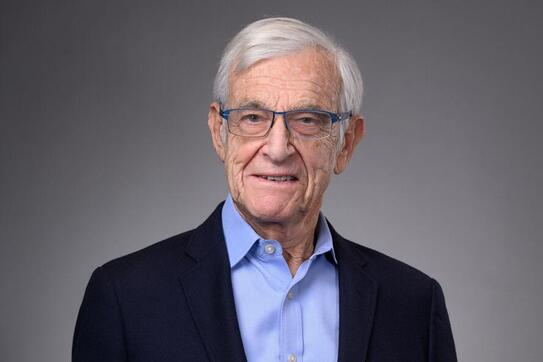

Venture capital wouldn't be the industry it is today without the contributions of its early pioneers, like Alan Patricof '57.

After earning an MBA from Columbia Business School in 1957, Patricof led a successful career in the investing industry and started one of the first venture capital firms, Alan Patricof Associates, in 1969. Later, in 1977, he founded Apax Partners, which would eventually grow to become one of the most successful private equity firms in the world.

Following the dot-com boom of the late 1990s, Patricof became a leading investor in media startups, such as The Huffington Post and Axios, as well as successful tech companies like Apple and Audible, among many others. Another of Patricof's firms — Greycroft Partners, which he started in 2006 — managed these investments.

In just the last few years Patricof has gotten married, penned an appropriately titled memoir, and completed the New York City Marathon at 88.

And of course he is still investing. In 2019, Patricof partnered with successful entrepreneur Abby Miller Levy to co-found Primetime Partners, which incubates and invests in the $8.3 trillion-dollar longevity industry.

Patricof spoke with CBS to give insight into his latest venture and the School's role in his successful career.

Columbia Business School: How did attending CBS prepare you for your early career in finance?

Alan Patricof: I graduated in 1957, and I will tell you that I only have good memories of the School. My primary memory is of the value analysis aspect and the financial skills in appraising.

I always get asked, 'Well, if you learned all about valuation analysis and value investing, then how come you went into the venture capital business, which is the antithesis of valuing investing?' I always say that those skills have helped me enormously in providing guardrails. In venture, you're dealing with analyzing markets and futures and a lot of theoretical hypotheses as opposed to value analysis, where you've got facts, and you're dealing with discounted cash flows and present value analysis.

More importantly, it has given me the framework to think about if we have the economics to pay for, not just the cost of goods but also the marketing of it.

CBS: What advice would you give to current business students or those who are early in their careers and are breaking into venture capital?

Patricof: I would tell them to think about the real economics of a business. Firstly, there's management — the jockey counts more than the horse. How do you build the business if you don't back the right team? It's about analyzing the skills of the CEO or the founder at the beginning. The second is understanding what I call the money mechanics of the business. It's great if you can build lots of revenue, but does it translate to bottom-line sustainability that allows a business to survive without the assumption that investors will fund something forever?

Ultimately, a company has to stand on its own. At the end of the day, every venture investment is putting your finger up in the air — analyzing markets and extrapolating the growth in markets. But it's helpful to complement that kind of thinking with some sense of reality.

CBS: What are your thoughts on the current AI revolution?

Patricof: I've lived through many revolutions. I've lived through the PC revolution, the storage revolution, the cellular revolution, the Internet revolution, and now the AI revolution. I've seen excitement come into areas and the boom or the bust. I've seen us go through a period of time when you have irrational exuberance. Everybody wants to be in it, and there's a lot of overvaluation, and you end up sometimes in the kind of bubble we had in the early 2000s.

AI is going to have a dramatic impact on everything in our lives. However, there is a lot of irrational exuberance in the market, and people are pricing companies that have no relationship to their potential earning power in the future. They just want to be in the business. I'm not predicting gloom or doom, but I know that some people out there will be hurt, and there will be some winners.

The winning aspect of AI will be in its applications. For example, its use can accelerate the development of a biologic or a drug to affect people living with Alzheimer's. The value of that drug company will be infinite. Instead of it taking 20 years to have a drug, we'll have it in maybe five or 10.

CBS: Can you tell us about the inspiration behind your latest venture, Primetime Partners?

Patricof: I may be more excited about creating and investing through Primetime Partners than almost anything I've done. Four or five years ago, I realized that one of the fastest-growing parts of the population is Baby Boomers. There will be more of them than children under 18 by 2030. This is a fast-growing segment of the population of people over 60, and people are living longer. So, there will be more of us that need related products, services, and technologies later in life.

CBS: Was there a standout moment before you started Primetime Partners where you thought, 'How is nobody thinking about this?'

Patricof: I have read a lot of reports on aging and longevity. I had gone to conferences, and my wife passed away from Alzheimer's in 2020 of Alzheimer's after having it for 12 years. During that time, I was front and center, seeing the problems with products and services when someone got sick.

CBS: Staying active is undoubtedly a massive part of longevity. What do you do to stay active?

Patricof: I have a trainer twice a week, and I eat carefully. I got married recently, and I have one crazy trait: we share every meal. That's helped me to keep disciplined. I also weigh myself twice a day, and if I gain more than two pounds, I skip a meal the next day, according to my doctors. I'm in unusually good shape.