Gift Planning

Plan Your Legacy at CBS!

Each person’s path to Columbia Business School is different.

The reasons and ways they give back are just as unique.

Thoughtful gift planning donors are crucial to the financial health of Columbia Business School.

With many different gift planning options, you can make an important investment in Columbia’s future and leave a legacy that fits your philanthropic goals. In addition, these gifts can provide significant benefits, including sizeable income, gift, and estate tax deductions; favorable capital gains tax treatment, and income for you and your family.

There are several creative ways you can make an impact.

- Make estate plans through a will or living trust.

- Create a charitable remainder trust and name the Business School as a beneficiary.

- Enter into a charitable gift annuity agreement with the School.

- Name Columbia as the beneficiary of a specific asset, such as a life insurance policy, retirement plan, or bank or brokerage account.

- Establish a donor-advised fund at Columbia.

- Give highly appreciated, illiquid assets that have an ascertainable value, like real estate or valuable tangible personal property.

- Make a gift of a business interest to the School.

- Make a Founders' Pledge to the School.

As the School and its remarkable network continue to drive the future of business, these contributions ensure ongoing support for vital programs and initiatives, as well as for generations of talented students and faculty.

Those who make planned gifts will also become members of the 1754 Society, Columbia University’s honorary association for alumni and friends who have included the University in their inheritance plans. Named for the year in which Columbia’s predecessor, King’s College, was established, the Society recognizes the vital role of benefactors in Columbia’s past, present, and future success. Your membership involves no dues, obligations, or solicitations, but rather permits the University to express its thanks, recognize your kindness, and encourage others to follow in your gracious footsteps.

For information on how you can make a lasting mark on this robust institution, please contact Talya Westbrook, Associate Dean of Development at (212) 853-4599 or [email protected].

Impact Makers

Susan Alexion ’79BUS

Columbia was part of her family for more than 50 years

“I want to ensure that future students are afforded the same opportunities that I had.”

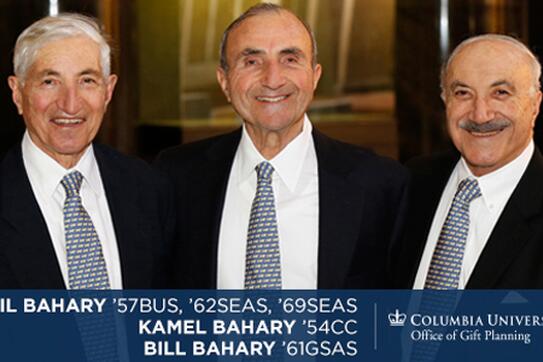

Bahary Brothers

Gifts from the Heart Support Research into the Mind

"By funding fellowships, we can provide support for students and their research for generations to come. What better way to show our appreciation to Columbia?"

Grace Frisone ’76SIPA, ’77BUS

Columbia Helped Her See the World; Now Her Bequests Help Others

“For me education has always been the great equalizer. Young people are our future, and they need our help to go to college.”

Cindy Graham Tether ’80BUS

Finding Joy Through Giving Back

“There's great joy in giving back, in creating a legacy for what one considers important, and in helping to make the world a better place."

Ben Hughes ’96BUS

Playing a Part in Columbia’s Future

“I’ve always believed in the importance of giving back. Our higher education system depends on it.”

Carlos Medeiros ’85BUS

Supporting His Family and Columbia

“I use my education every day. That is the reason for my gift.”

Jooyun "Julie" Oh Ybarra ’98BUS

A Savvy Businesswoman Plans for the Future

“When you do make a charitable gift, start with your most appreciated securities."

Louis A. Parks,’95GSAS, ’03BUS, ’12GS

The Gift of Lifelong Learning

“My wife, Ann, and I want to provide an example to our children to give back to their institutions of learning as well as to their communities during and after their lifetimes.”