It's an open secret in U.S. climate policy circles that the Inflation Reduction Act got its name for purely political reasons. It's a climate bill, after all. Calling it “Inflation Reduction Act” was just the marketing term to help sell it to a skeptical public more worried about rising prices than temperatures in August 2022.

Temperatures have only risen since, while inflation is down, and the Inflation Reduction Act had nothing to do with either. But to see why the name was more than appropriate only takes going back a further six months.

On February 24, 2022, Russian president Vladimir Putin launched a full-scale invasion of Ukraine. In many ways, the step shouldn't have come as a surprise. The invasion followed months of saber-rattling. It wasn't even Putin's first invasion of Ukraine — that happened ten years earlier, with Russia's forceful annexation of Crimea. But Russia's bombs raining down on Ukraine still came as a shock. February 24 was a Thursday. By Sunday morning, Germany had changed 75 years of pacifist defense strategy. Another result of the invasion: fossil energy price spikes.

Now, two years later, it has become clear that the shock of the war has changed the trajectory of global energy and climate in ways that we are only beginning to appreciate. It is also precisely where the U.S. Inflation Reduction Act enters the picture, and why history will judge the law — and its name — kindly. Let me explain.

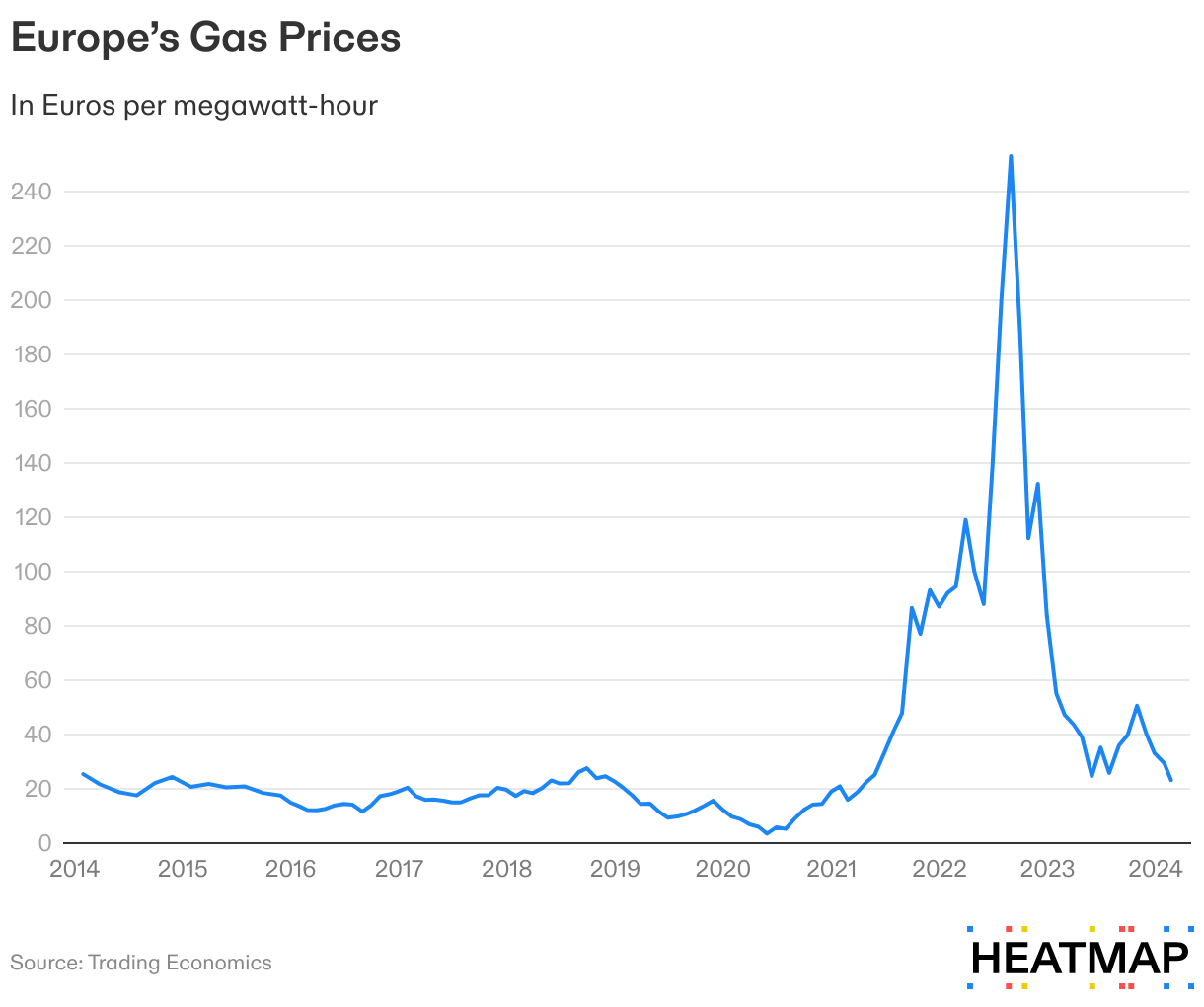

Gas prices in Europe had already been high all winter before Russia's invasion, in part in response to Putin's posturing. After the invasion, they spiked. The peak happened in August 2022, in anticipation of the Russian war lasting through the coming winter and worries about the war dragging on. Drag on, of course, it did. Two years in, there's no end to the fighting in sight. Gas prices, meanwhile, are down again to levels not seen since well before the invasion.

One key reason: demand is down. Europe's gas demand was down almost 18% in the first year after the invasion, compared to the year before. Not all of that is good news, for the climate or otherwise. One reason for decreased gas demand had been temporarily increased coal use. Another is a sputtering European economy.

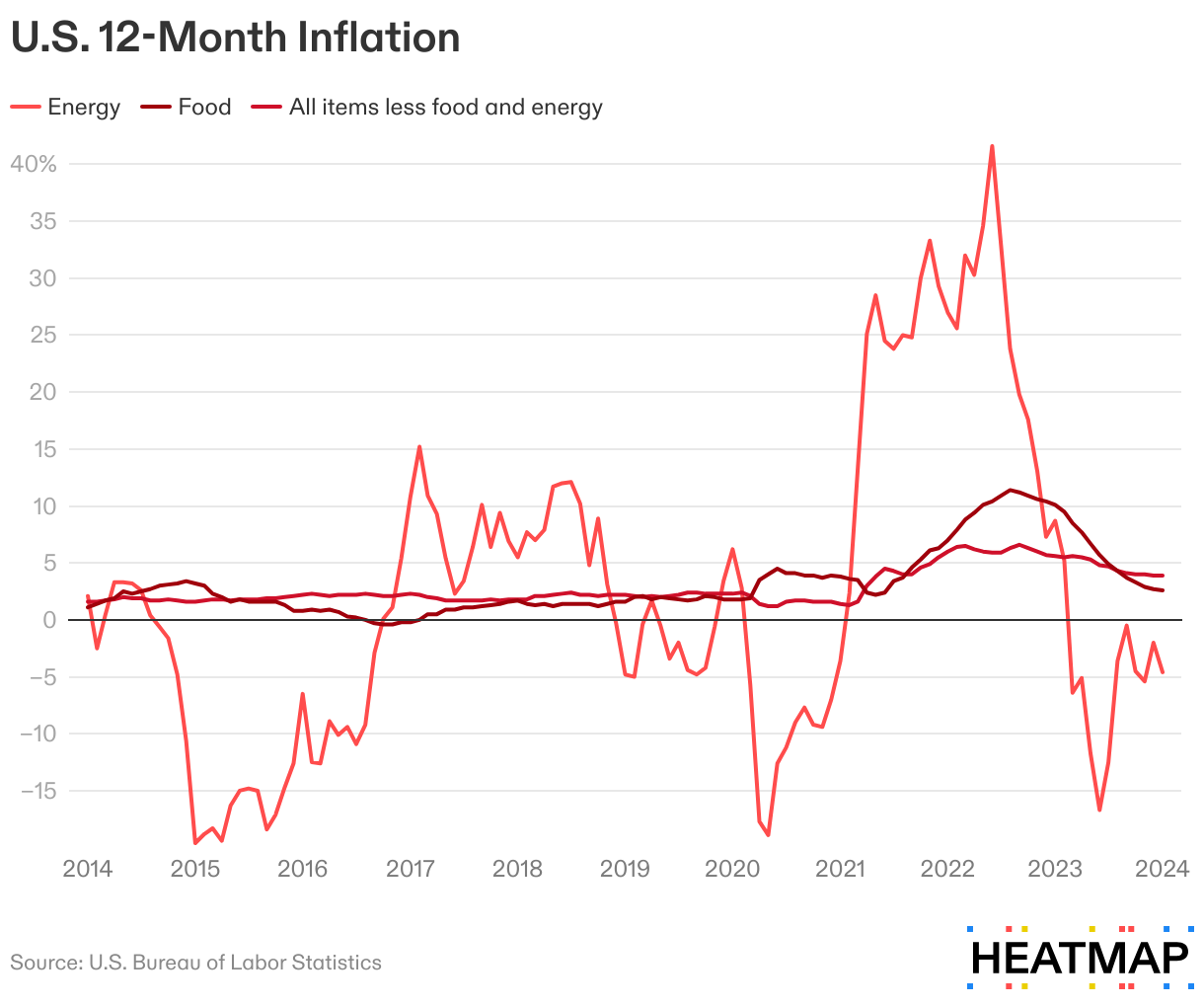

The U.S. had been relatively insulated from these extreme fluctuations. But it, too, saw gas prices spike in August 2022. The spike, to be clear, was much lower than in Europe. Gas, unlike oil, is a regional market. But the economic upshot was similar everywhere: massive inflation driven by volatility in fossil fuel prices, or “fossilflation” for short.

All of us, the global economy, and the fortunes of political leaders everywhere are at the mercy of geopolitical vagaries. Putin blows a fuse and invades Ukraine, and your gas bills spike – both types of “gas” bills, by the way: gasoline to get to work, and methane gas to heat your home. Electricity bills typically are not far behind, with gas-powered plants that can be called upon at a moment's notice providing a necessary margin of safety during moments of peak demand. That means that they — or, by extension, Putin, in this case — set the price.

Don't take my word for it. The U.S. Bureau of Labor Statistics unpacks the underlying drivers of inflation into three main categories: food, fuel, and everything else. Throughout the most recent U.S. spike in inflation in 2022, the energy category alone was responsible for around half of total inflation. And that's just counting the direct effects. Indirectly, a good portion of the food price increases ever since are also due to higher energy costs. If the farmer pays more to harvest the crop, soon those commodity prices increase as well. Of course, it isn't all fossil fuels. Putin's invasion, for example, also impacted corn production in the Ukraine directly, by destroying crop land, preventing a timely harvest, and cutting off export routes.

There are two other climate-related factors that drive inflation — call them “climateflation” and “greenflation,” to use German economist Isabel Schnabel's terms. Schnabel — a member of the Executive Board of the European Central Bank, the body that sets interest rates for the 340 million people in the Eurozone — introduced all three -flationary terms in a March 2022 speech warning of “a new age of energy inflation.”

Climateflation is just what it sounds like: inflation because of unmitigated climate change. When an extreme weather event wipes out a country's harvest of a particular crop, prices spike. One year it's avocados, the next sugar, and more significant food staples like corn, rice, and wheat are never far behind. The long-term prescription, much like with fossilflation: get off fossil fuels.

None of that will happen overnight. That, in a sense, makes the IRA a horrible political strategy with an eye toward the next election cycle. Want to cut inflation quickly? Make gas and gasoline cheaper with direct handouts. Hello, gas tax holidays!

The problem with that policy quick fix is that it's just that: decidedly short-term thinking. Fossil energy use will go up as a result. In fact, several U.S. states and European countries have done just that in response to Putin's invasion. As a result, the average price paid per ton of CO 2 has gone down in 2022, after a decade of steadily rising carbon prices the world over.

The IRA famously does not establish a carbon price either, and that's A-OK. It does establish a $900-per-ton price for methane paid by oil and gas companies, but the law is decidedly more carrots than sticks. That contrasts U.S. climate policy with what has been the primary focus of the EU, with its emissions trading system and national carbon taxes. It also addresses a more subtle type of climate-related inflation: greenflation, upward pressure on prices because of the rush to get off fossil fuels.

The good news on that front: It seems to be true that there's plenty of the kinds of precious metals and rare earth minerals we need to power the low-carbon transition to go around. Polysilicon prices spiked for a bit, before new supply came online, and solar panel prices never budged from their decades-long, precipitous decline. Lithium, nickel, and other minerals used in batteries and other low-carbon technologies similarly rose for a bit before they, too, declined precipitously.

The post-fossil fuel transition will still take plenty of active management and proactive policy. That is where the U.S. IRA shines, and where the EU, despite its head start and overall ambitious climate policy, is playing catchup.

In May 2022, the European Union passed REPowerEU, a broad set of measures to cut off Russian gas within five years. By September of that year, the EU had cut Russian gas as a percentage of total gas piped in from abroad to under 10%, down from over 40% a year prior. Germany built three LNG import terminals in record time, and lots of other measures showed almost immediate effect.

Overall, the EU is now racing to catch up with the U.S. in the global climate race with its own set of ambitious supply-side measures in form of a broad Green Deal Industrial Plan. We should all applaud that transatlantic climate policy competition and embrace the newly rekindled green growth mindset. Done right, the planet will emerge as a winner, and so will our economies.

The IRA has not and will not cut inflation overnight. But that fight is indeed a big part of the bill's legacy: Play the long game of tackling all three types of climate-related inflation — fossilflation, climateflation, and greenflation — at their very core, and indeed justify the law's name.

This article was originally published on Heatmap.