Key Takeaways

- New research shows that founder personality is associated with startup success across stages of a venture’s development - from initial fundraising to exit.

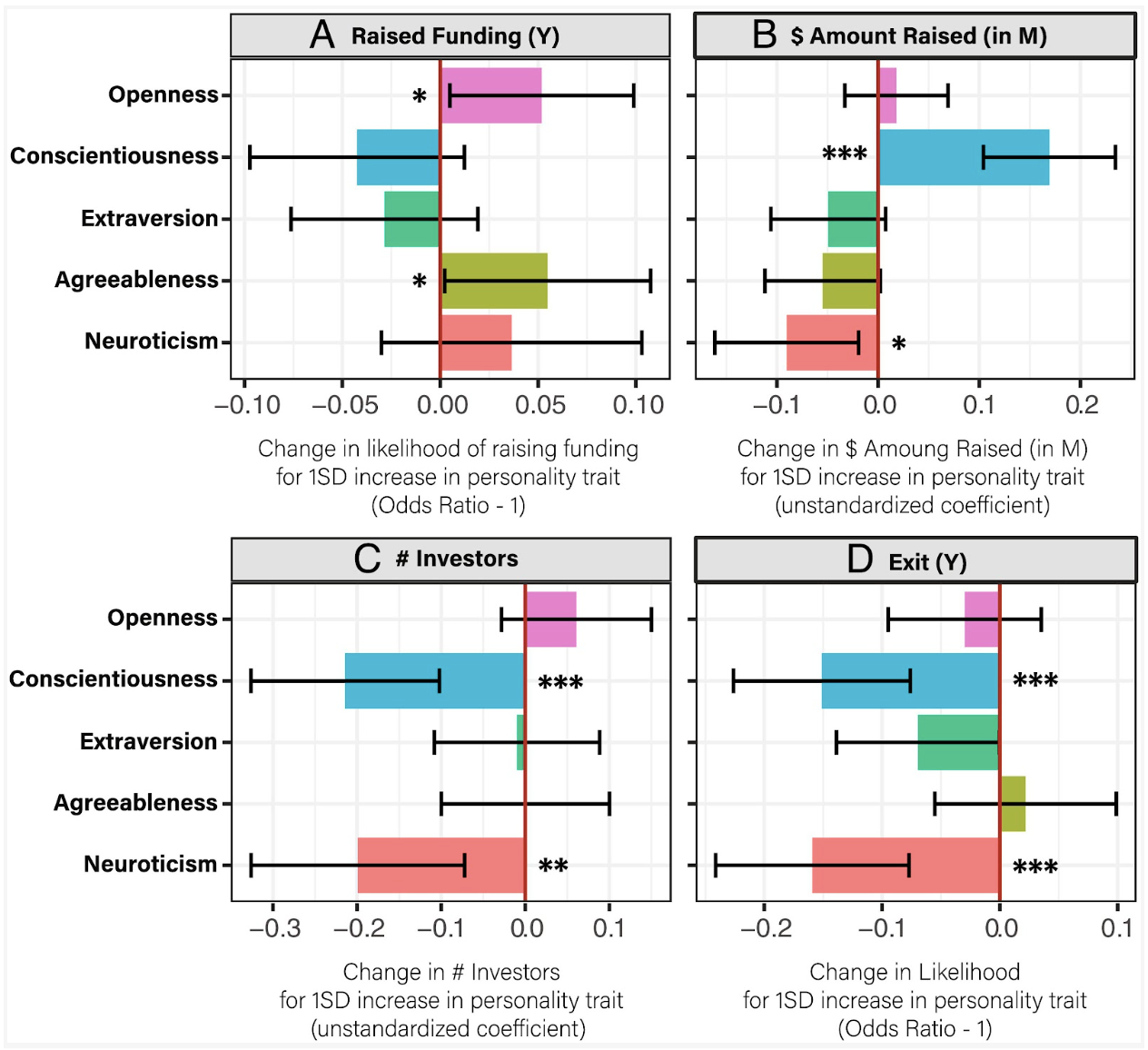

- Founders who score high on openness and agreeableness are more likely to raise funding, emotionally resilient founders fare better across all venture stages, and highly conscientious founders fare better in the earliest stages such as amount raised during initial fundraising, but are less likely to achieve high-growth exits such as acquisition or IPO.

- The insights could inform venture capitalists’ investment decisions, especially during the earliest stages of startup development, when few hard metrics are available and success is most unpredictable.

Adapted from “Founder personality and entrepreneurial outcomes: A large-scale field study of technology startups” by Brandon Freiberg and Sandra C. Matz of Columbia Business School. The paper explores how founders’ personalities affect startups success, all the way from raising capital to successfully exiting via acquisition and IPO.

The Research

Many venture capital investors (VCs) say they bet on a startup’s founder, or founding team, not necessarily on a business plan.

Often, a charismatic founder’s personality is a big part of what persuades VCs to become financial backers, especially in the earliest stages when little exists in the form of financial track record. At the moment, however, most investors rely on instinct rather than rigorous methodology when evaluating the personalities of founders who pitch them. They may sense that a founder has “it,” the elusive quality that drives success, but not be able to put their finger on exactly what that “it” quality is.

It turns out they are onto something in betting on founders’ personalities, with new research by Freiberg and Matz linking founder personality to startup success across all stages of a venture’s development.

To study the relationship between founder personality and startup outcomes, the researchers used recent advances in natural language processing to predict the Big Five personality traits of 10,500 startup founders from their Tweets. They then linked these five traits – including openness, conscientiousness, extraversion, agreeableness and neuroticism – to objective startup outcomes from the online repository Crunchbase.

The four outcomes studied spanned all stages of startup development:

1. Whether the startup raised funding

2. Amount raised in their first funding round

3. Number of investors in their first funding round

4. Whether the startup achieved exit via acquisition or IPO

The researchers drew several conclusions:

- Founders’ personalities matter. Founders’ personalities can provide important predictive clues across all stages of a venture’s development. Particularly in the early stages of venture formation – when little objective performance data is available – such insights could help investors forecast both short and long-term success.

- Specific personality traits give founders an edge. The two traits with the biggest impact on startup success are conscientiousness and neuroticism. Conscientiousness is helpful in the early-fundraising stage when planning and attention-to-detail are critical. But it can work against an entrepreneur in the later stages when flexibility and rapid adjustments might become necessary to scale the business and accomplish a successful exit. Neuroticism hurts an entrepreneur at every stage, highlighting the importance of emotional stability, self-confidence and resilience in overcoming obstacles among startup founders.

- It’s not just about the founders. Founder dispositions and investors preferences – and the interaction of the two – ultimately influence which types of personalities are most successful at particular stages of a startup’s lifecycle.

Founders’ Personalities Predict Startup Outcomes

The chart below shows the relationships between founders’ Big Five personality traits and startup outcomes.