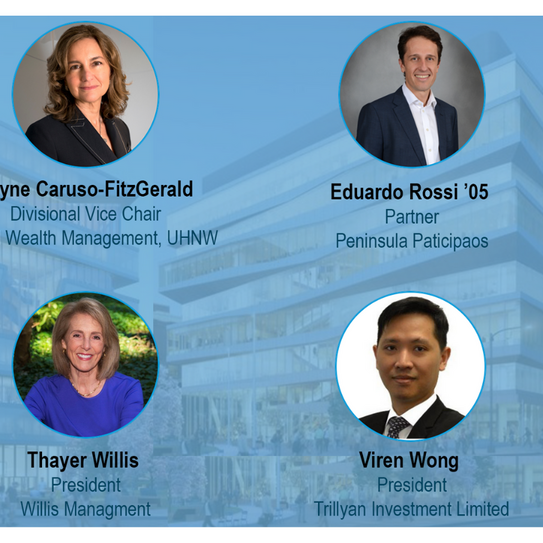

| Speakers | |

| Jolyne Caruso-FitzGerald | Divisional Vice Chair, Global Wealth Management, UHNW, UBS |

| Eduardo Rossi ’00 | Vice President of the Board of Peninsula Participacoes |

| Thayer Willis | President, Willis Management |

| Viren Wong | President, Trillyan Invstment Limited |

| Moderator | |

| Professor Patricia Angus | Managing Director, Global Family Enterprise Program |

About this session

The panelists on this session gave us an inside look at the missions and family dynamics in family offices. They spoke about some of the difficulties of keeping younger family members engaged as family businesses grow, and also highlighted some things to consider when deciding who should run a family’s office and how they should do it.

What is a family office, and when / how do they come to be?

A family office was defined as the place where a family’s emotional system meets its financial life. Family offices typically grow out of a need to invest the family’s profits from some other investment or operating business. They are usually involved in the realms of estate planning, family planning, and family governance. Family offices are often large investment organizations, frequently responsible for investing assets of $100 million or more and, more commonly, over $1 billion of AUM.

Mission of a family office

Although wealth preservation and growth are usually one aim of a family office, there can be nuances in how families choose to invest their wealth. For instance, the panelists called out that family offices tend to invest in causes that they care about and that are close to the family. To illustrate, in the past few years there has been a big push to move family office funds into ESG-friendly investments. Jolyne Caruso-Fitzgerald shared research findings indicating that 56% of families invest with a sustainable overlay, and 19% of family offices invested in sustainable investments in 2019, a number which is forecast to grow to 37% by 2023.

Additionally, there might be some geographic differences in what family offices are focused on. For instance, Viren Wong, who heads a family office in Hong Kong, commented that family offices are a relatively new concept in China, as true wealth creation has really happened in the last 10-15 years there. As such, family offices are often focused on growing this wealth as well as increasing exposure to international markets so that later generations of the family can work across borders more easily.

Who should run a family office?

Family offices are typically either run by a member of the family or an external manager. In each case, there can be difficulties for the family if the hiring and retention process is not considered thoughtfully. If a family member runs the office, there can be issues around selecting that member and allowing other members to join the operation. If an external manager is hired, that manager also must be conscious of potential conflicts between various family members and must work in the best interest of the family at large. The panelists left us with two tips: to make sure that family members get equitable benefits from the family office, and to hire someone with broad cross-functional expertise so that the manager can be adept enough to continue to shift the family office’s strategy as the family’s needs change.

Family Dynamics in Family Offices

Engagement of younger members of a family was a critical point that was called out by the panelists. They highlighted the ability of family offices to augment family members’ understandings of who they truly are. They can do this by offering a pathway to join the family office if members prove their ability by working outside of the family office for several years before joining. Some family offices add the stepping-stone requirement that the young adult must receive a promotion while working outside of the family office. In families where there is still an operating business, this strategy is even more useful. The same principle applies: work outside the family business and receive a promotion before beginning a career in the family business. Having this requirement helps family members be well prepared to join their family office or family business.

Additionally, the panelists emphasized that family offices can be more difficult to manage than family businesses, because family businesses often have been around for several generations, whereas the family office concept is relatively new. The unprecedented levels of wealth that many families have accumulated can lead to strife among family members when it comes to issues of investment and governance. At the end of the day, the panelists agreed that the best way for the family to stay together is to attend to a broad definition of wealth including family psychology, and not focus exclusively on the financial resources. One of the ways families do this is to continue to reiterate the family’s story to each member in a way that brings family members together and affirms the strength of the family when its members work alongside one another.