Top Takeaways

- Culture is the biggest off balance sheet asset of the company

- Leadership doesn’t always appreciate the value of corporate culture, and as a result often underinvests in it

- Employees implement what they see executives modeling, so “walking the talk” of the company’s stated values is critical

- Understanding and beginning to quantify corporate culture can be an edge for investors

Adapted from “Corporate Culture: Evidence from the Field,” by John R. Graham and Campbell R. Harvey of Duke University, Jillian Grennan of Santa Clara University, and Shivaram Rajgopal of the Columbia Business School.

Research

Corporate culture may be one of the most important features of a company, but it is also among the least appreciated and poorly quantified. Recent research documents how corporate culture underpins nearly everything employees do, and even influences value creation via worker output and perceived attractiveness as targets of mergers or acquisitions. The findings have important implications for managers and for investors as well.

Relying on surveys of 1,348 executives at North American companies, the researchers compile views on what corporate culture is and how it works in practice.

As the researchers note, “91% of executives believe culture is important to their firms and 79% place culture among the top value drivers of their company. Fifty-four percent of executives would walk away from an acquisition target that is a poor cultural fit, while another 33% would require discounts between 10%–30% of the purchase price of the target.”

Finally, they conclude, “An overwhelming 85% of executives believe an ineffective culture increases the chances that an employee might act unethically or even illegally.” Executives link culture to a wide range of actions and decisions, including ethical choices (such as compliance and short-termism), innovation (including creativity and risk taking), and value creation, as noted above.

Strikingly, only 16% of the interviewees say their company culture is where it needs to be, and most blame an underinvestment in culture. “Even more surprising, nearly one-fifth of respondents indicate that senior leadership works against the firm’s corporate culture being effective,” the researchers note. That may be because leadership is influenced by forces such as impatient investors and inadequate governance structures, they suggest.

Importantly, the paper draws a distinction between a firm’s stated values—what it claims to prioritize, such as integrity and honesty—and its norms, which is how its people actually behave on a daily basis.

As the paper makes clear, that’s why culture isn’t just a touchy-feely concept for recruiters or marketers. It’s a value driver, and one investors would do well to pay attention to. As co-author Shivaram Rajgopal puts it, “Culture is the biggest off-balance sheet asset of the company.”

Because it’s so nebulous even for those at the helm of a company, culture may be even more challenging for investors to identify. Still, Rajgopal says, opportunity lies in developing new perspectives and ways of analyzing things that may be hard to quantify.

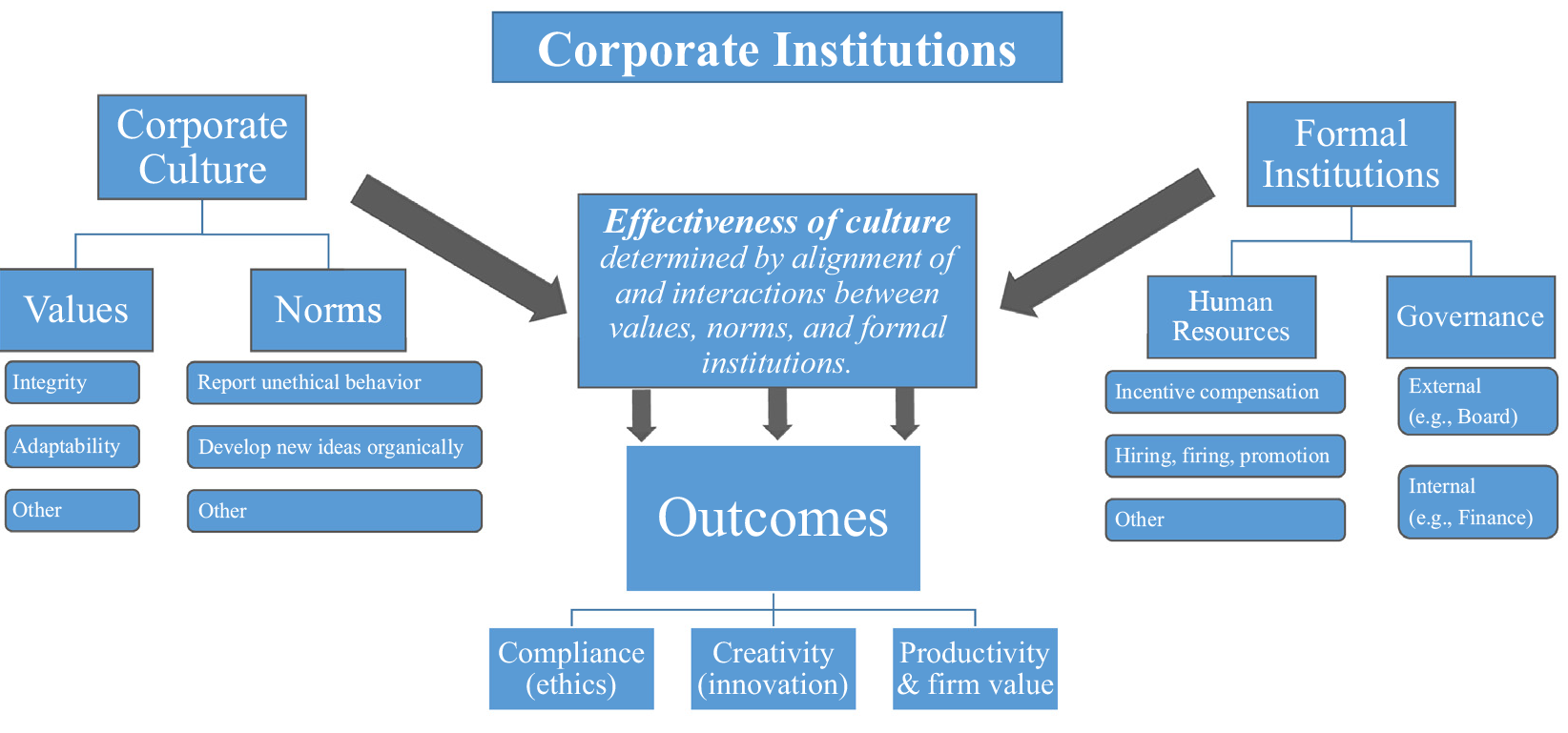

According to North (1991), institutions can be classified as informal and formal. We define corporate culture as an informal institution comprised of cultural values and cultural norms. The values and norms characterize the structure in place that guides employees’ actions when they face unforeseen contin- gencies. A cultural value represents an ideal state of behavior such as integrity or adapt- ability. Cultural norms are the day-to-day living out of the cultural values via the typical patterns of conduct. An effective culture is one that promotes the behaviors needed to successfully execute the firm’s strategies and achieve its goals. The effectiveness of culture is determined by alignment of and interac- tions between values, norms, and formal institutions.

North, D.C., 1991. Institutions. J. Econ. Perspect. 5 (1), 97–112.

Conclusion

Corporate culture pervades everything a company does, and as such is a critical driver of financial value, influencing everything from best practices to productivity. It can best be understood as the values a corporation espouses, and whether or not its people are living up to those ideals in the work they do. Disconnects may be red flags for potential hires, leadership, or the investing community.

Executives would like to see values and norms aligned, for employees to “walk the talk,” as the researchers put it. But employees look to the top, and if executives aren’t modeling the values, rank-and-file workers may not implement them.

A disconnect between values and norms may result in lower productivity, higher turnover, or in a worst-case scenario, bad behavior. Think of bank employees opening phony accounts in customers’ names, for example, or a car company tweaking vehicle software to produce false emissions readings.