2023 - 2024

The Heilbrunn Center recently welcomed two new members to the Center's Advisory Board. Kim Lew, President and Chief Executive Officer, Columbia Investment Management Company and Michael Mauboussin, Head of Consilient Research, Counterpoint Global at Morgan Stanley joined the distinguished group of professionals which provides invaluable guidance and advice to Professor Santos and the Heilbrunn Center. To learn more about the Heilbrunn Center's advisory board, read here.

Welcome to the Value Investing Program Class of 2024!

Students are selected for the Program through a competitive application process and complete a set of 7 courses including: Modern Value, Applied Value Investing, The Credit Superhighway, Economics of Strategic Behavior, Value Investing with Legends, and two elective courses from a menu of Heilbrunn Center courses. Besides access to world-class practitioners who teach the Value Investing Program courses, students in the Program also receive access to special programming, including recruiting and career workshops, mentors, and various networking events. The Heilbrunn Center also maintains a resume book for students in the Program that is sent to employers upon request. If you are interested in recruiting from the Value Investing Program, please contact Meredith Trivedi at [email protected].

In addition to the Center’s regular course offerings, we are pleased to offer several new electives including Activism as a Value Strategy taught by Jeff Gramm '03 and Terry Kontos '05; Applied Credit Investing taught by Sheldon Stone '78 and Bill Casperson and; The Analyst's Edge taught by Adam Birnbaum '08 and Shayan Mozaffar '11.

International Executive Education

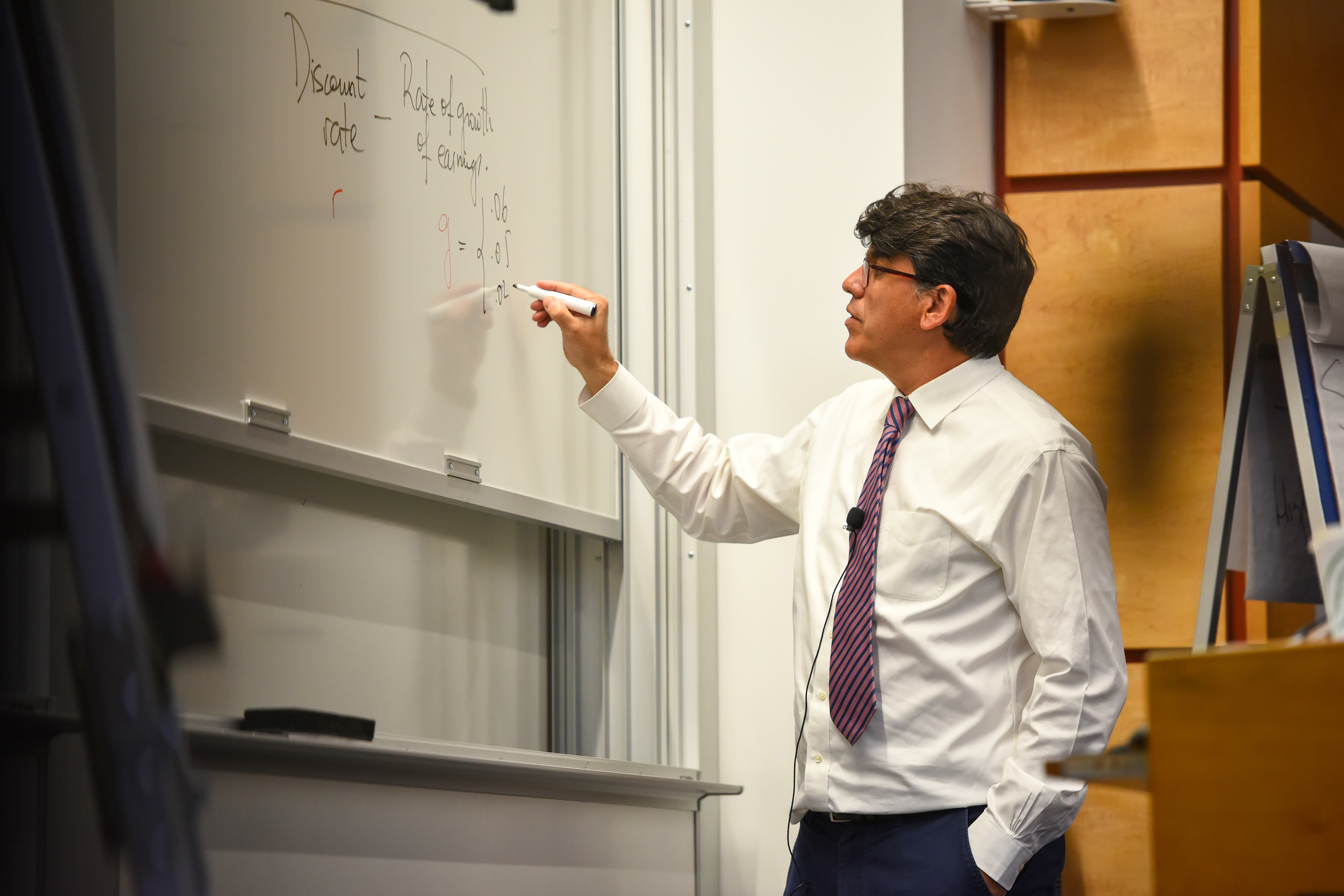

The Heilbrunn Center will travel to London in September 2023 to host an open enrollment Executive Education program on Modern Value. Taught by faculty director Tano Santos, the Robert Heilbrunn Professor of Finance and Asset Management, this is the second Modern Value program offered by the Center internationally.

To learn more visit https://www8.gsb.columbia.edu/valueinvesting/LondonProgram.

Stay Involved and Upcoming Events

There are many ways to engage with the Heilbrunn Center and our students.

Mentor a Student

As part of the Value Investing Program experience, each student is paired with at least one industry professional to provide guidance and advice on career development, feedback on pitches, and other assistance with networking and recruiting. This mentorship provides our students with the invaluable opportunity to engage one-on-one with an active member of the investing community and has led to many lifelong professional friendships. For those unable to commit the time to a formal mentee, we also offer mock interview preparation for the VI Program students and are building a directory of practitioners to conduct mock interviews on a one-off basis.

If you are interested in participating with the mentorship or mock interview program please contact Julia Kimyagarov at [email protected].

Speak on Campus

The Heilbrunn Center, in conjunction with CSIMA, hosts a regular professional development series for students to hear from and ask questions of practitioners in a small group setting. If you are interested in speaking on campus please contact Meredith Trivedi at [email protected].

Judge a Stock Pitch

Participate as an IIC judge, CSIMA Stock Pitch Competition judge, Applied Security Analysis practice pitch judge or meet with students individually to provide feedback on their verbal and written stock pitches. If you are interested in serving as a judge, please contact Meredith Trivedi at [email protected].

Upcoming Events

The Heilbrunn Center has planned a robust calendar of events for students and the alumni-practitioner community during the 2023-2024 academic year. Listed below are Center's open events. For a calendar of student-only events, please visit campus groups or email Julia Kimyagarov at [email protected].

| 4th Annual Roger Murray Lecture Series (Virtual)

TBD |

The 5th Annual Artisan Challenge January 2024 |

|

33rd Annual Graham & Dodd Breakfast featuring John Armitage Friday, October 13, 2023 |

The 27th Annual CSIMA Conference February 9, 2024 |

|

8th Annual CSIMA Stock Pitch Challenge (Virtual) Thursday, November 2 & Friday, November 3, 2023 |

The 17th Annual Pershing Square Challenge April 2024 |

|

2nd Annual Kawaja Growth Stock Pitch Challenge Friday, November 10, 2023 |

The 14th Annual “From Graham to Buffett and Beyond” Omaha Dinner Friday, May 3, 2024 |

Registration for the 33nd Annual Graham & Dodd Breakfast featuring John Armitage, Egerton will open in mid-August.

John Griffin, Founder, Blue Ridge Capital and Jan Hummel, Founder, Paradigm Capital, are confirmed keynote speakers for the 27th Annual CSIMA Conference on February 9, 2024 in New York. Further details on speakers to follow.

Value Investing with Legends podcast

If you do not already, listen and subscribe to the Value Investing with Legends podcast hosted by Tano Santos and Michael Mauboussin. We look forward to launching the fall 2023 season with a spectacular line-up.

Read other features on the the Heilbrunn Center and our programming: