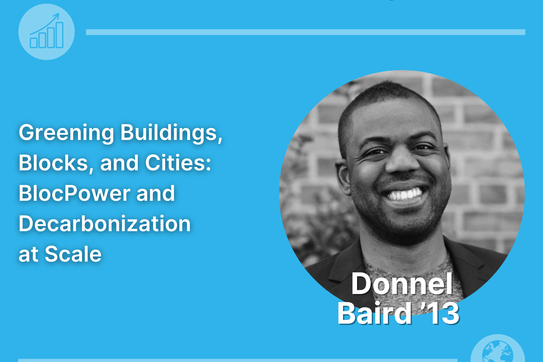

Greening Buildings, Blocks, and Cities: BlocPower and Decarbonization at Scale With Donnel Baird ’13

Donnel Baird ’13 is the founder and CEO of BlocPower, a clean tech startup based in New York City that develops portfolios of clean energy retrofit opportunities in underserved communities and connects those opportunities to investors seeking social, environmental, and financial returns.